TL;DR

Inverse Head and Shoulders is one of the highest-success bullish patterns (80%+) and, although rare, is extremely powerful when it appears. altFINS’ AI detects these setups automatically, along with hundreds of other chart pattern signals each day, across 4 time intervals (15m, 1h, 4h, 1d).

Traders can find them in Chart Patterns and Signals Summary, set alerts, and follow tutorials to learn entries and stop-loss placement. These high-probability patterns are worth waiting for, and altFINS makes spotting them effortless.

Inverse Head and Shoulder Chart Patterns

Currently, there are several assets trading in an Inverse Head and Shoulders pattern.

That pattern, along with Head and Shoulders, has the highest success rates.

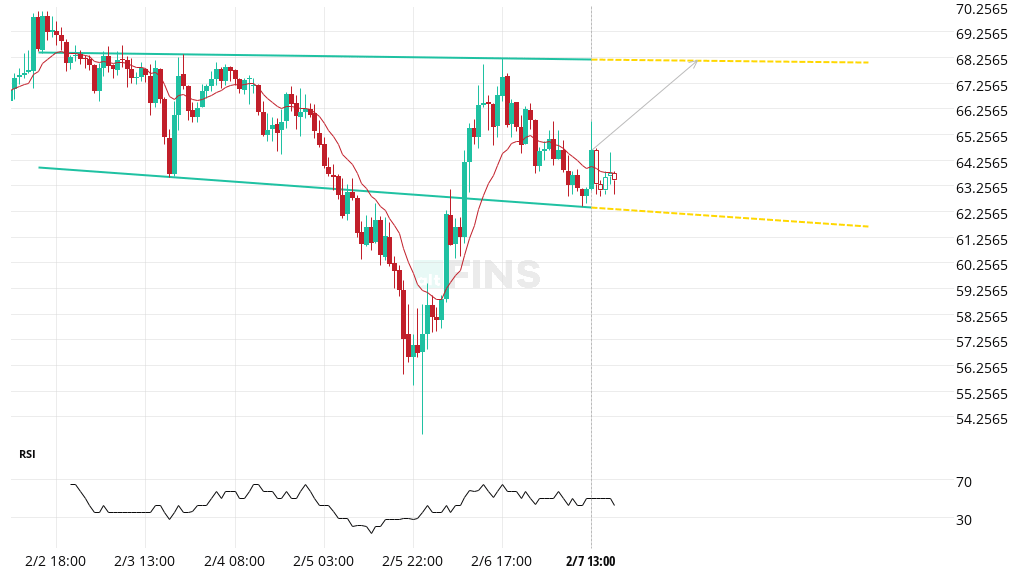

An example of an Inverse Head and Shoulders pattern identified by our AI Chart Pattern detection is Quant (QNT):

QNT: Inverse Head and Shoulders Pattern (1H interval)

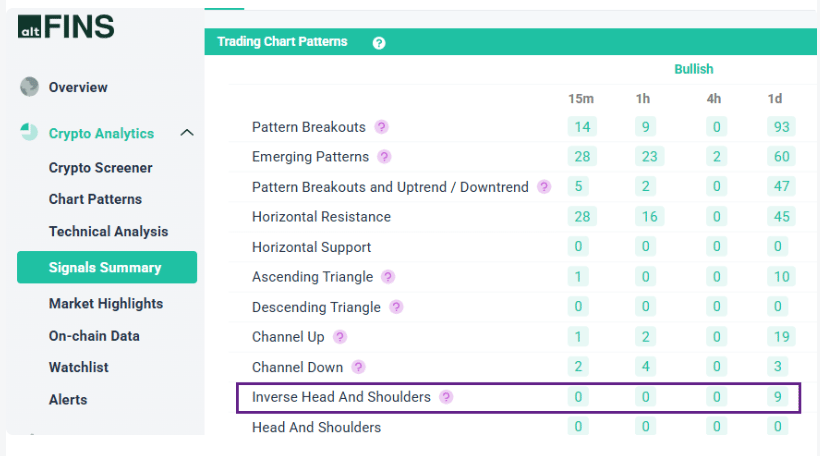

Our system generates over a hundred signals for chart patterns every day! Channels, wedges, flags, resistance breakouts, etc. across four time intervals.

Some patterns have statistically higher success rates than others (see below for historical data).

Inverse Head and Shoulders (Bullish) and Head and Shoulders (Bearish) are among patterns with the highest hit rates!

These are also some of the rarest patterns. But they're well worth waiting for. And wait is all you need to do because altFINS automatically detects the patterns for you.

You can find these and others in our Chart Patterns section as well as Signals Summary section.

TIP: Never miss another trading signal. Create an alert for any chart pattern and receive notifications on your phone!

Signals Summary: Trading Chart Patterns

What Are AI Chart Patterns?

altFINS AI-based Chart Pattern recognition engine identifies 26 trading patterns across multiple time intervals (15 min, 1h, 4h, 1d), saving traders a ton of time, including:

Ascending / Descending Triangle

Head and Shoulders, Inverse Head and Shoulders

Channel Up / Down

Falling / Rising Wedge

Double Bottom / Top

Triple Bottom / Top

Bullish / Bearish Flag

Bullish / Bearish Pennant

Rectangle

Support / Resistance and other.

Price patterns appear when traders are buying and selling at certain levels, and therefore, price oscillates between these levels, creating chart patterns.

When price finally does break out of the price pattern, it can represent a significant change in sentiment.

Watch this introduction video to learn more about our AI chart patterns.

But how to trade chart patterns?

Beginners should stick with the patterns that are easiest to understand and have the highest success rates.

/